June 23, 2025

How to Deal with Insurance Adjusters After a Personal Injury Accident

There’s a certain irony in surviving the chaos of a personal injury accident — blood, glass, pain, paperwork — only to find yourself negotiating your own worth over the phone with a stranger in a suit.

The accident was sudden. Brutal. Honest, in its own way. But what comes after? That’s where it gets murky. Because now, the world wants you to explain yourself. To be measured, reasonable, and careful.

And just when you’re trying to piece your life back together, the insurance adjuster calls — calm voice, friendly tone, and questions that feel simple but carry the weight of a trap.

You wonder, are they trying to help? And then it hits you that help rarely comes scripted.

According to the U.S. Department of Justice, approximately 96% of personal injury claims are resolved before reaching trial. Many of these outcomes are shaped through early conversations with adjusters. How we respond in those moments can influence the entire direction of a claim.

Let’s look at how to approach these conversations with care and clarity.

1) Watch What You're Saying

When an insurance adjuster contacts you, it’s a calculated part of the claims process. Their questions may sound casual, but every response you give is evaluated for how it might limit the insurer’s liability. That’s why caution matters from the very first exchange.

One of the most common requests adjusters make is for a recorded statement. They may frame it as a routine step to “get your side of the story.”

However, early recordings often occur before you’ve had time to process what happened or understand the full extent of your injuries. At that stage, even a well-meaning answer can work against you later. You might unintentionally downplay symptoms, misstate a timeline, or phrase something in a way that casts doubt on your account.

In Florida, there’s legal protection built into this process. The state follows a two-party consent rule, meaning both you and the adjuster must agree before any phone conversation is recorded.

If an adjuster records without your consent, that could constitute a violation.

(Source: Florida Statutes § 934.03).

If you don't understand how to proceed, it’s entirely appropriate to decline the conversation or request that all communication go through your attorney. Doing so doesn’t signal you’re hiding anything—it ensures you’re not stepping into a process unprepared.

2) Don’t Admit It Was Your Fault

In the moments after an accident, there’s often confusion, adrenaline, and a strong urge to explain. When the insurance adjuster calls, it’s common to try and fill in the blanks or offer your version of what happened. However, these conversations are not casual—they are part of a larger process that determines liability. Even subtle phrases like “I didn’t notice them at first” or “I guess I was in a hurry” can shift the direction of your claim.

Florida law doesn’t require you to prove perfection, but it does require precision. Under the state’s modified comparative fault system, each party is assigned a percentage of fault.

Your compensation is reduced in proportion to your share of responsibility. More importantly, if you're found to be more than 50% at fault, you are barred from recovering anything at all (source: Florida Statutes § 768.81).

Insurance adjusters are trained to listen for these cues. Their questions may seem simple, but they’re designed to gather admissions or inconsistencies that can later be used to reduce your recovery or deny the claim altogether. At this early stage, you don’t yet have all the facts—surveillance footage, witness accounts, vehicle data—so drawing conclusions about who was at fault can be premature and costly.

The better approach? Keep responses limited to objective details—time, location, basic facts—and avoid opinions or speculation. Let your legal team gather evidence and analyze fault based on the full record. The less said about blame, the more protected your case will be.

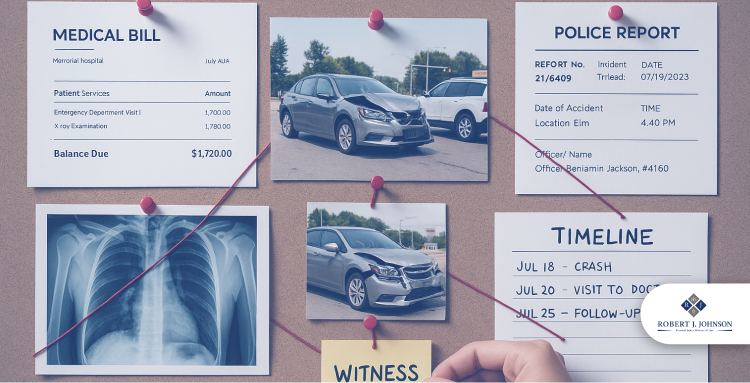

3) Save Every Record That Shows What Actually Happened

In a personal injury claim, memory can fade—but records don’t. Every detail you document becomes a building block in your case. While your account of the accident matters, what truly carries weight are the reports, receipts, and written statements that back it up. Insurance companies deal in evidence, not assumptions, which is why preserving a complete and accurate file is so important.

The average cost of an injury-related emergency room visit exceeds $3,000

(Source: Centers for Disease Control and Prevention).

Begin collecting materials as soon as possible. Medical documentation should include more than just discharge notes—it should show diagnoses, follow-up visits, medications prescribed, and physical therapy recommendations. These reports provide a timeline of your recovery and tie your injuries directly to the incident.

The police report offers another layer of credibility. It captures the responding officer’s observations, citations issued, and any preliminary conclusions about fault. That report often serves as a neutral foundation for your version of events.

Third-party statements—whether from bystanders, passengers, or others involved—can strengthen your claim by confirming the sequence of events or clarifying who caused the collision. Photos of the scene, vehicle damage, road conditions, or injuries offer visual evidence that words alone can't provide. If the property was damaged, keep repair invoices and estimates as well.

4) Don’t Accept the First Settlement Too Quickly

It’s not uncommon for insurance adjusters to extend a settlement offer soon after an accident, sometimes within days. The timing is intentional. They know you’re dealing with medical bills, lost income, and uncertainty. A quick check in hand can seem like a solution. However, accepting too early can mean signing away far more than you realize.

Settlement agreements are final. Once accepted, you typically waive the right to pursue additional compensation, even if future medical issues arise. For example, a neck or back injury might not show its full impact until weeks later.

If you've already agreed to a low offer, you may be left covering long-term treatment costs out of pocket. A qualified attorney can evaluate the full scope of damages—immediate and ongoing—and help ensure the offer reflects those realities.

According to research, individuals with legal representation recover 3.5 times more on average than those who handle claims alone

(Source: Insurance Research Council, Claiming Behavior Study).

Before agreeing to any settlement, consider whether it covers both just today's expenses and tomorrow’s complications. A fast payout rarely equals a fair one.

Visit the related posts to know more about personal injury cases

The Dangers of DUI Accidents Protecting Your Rights as a Victim

How are Personal Injury settlements Paid out?

5) Count Everything You’ve Lost

After a personal injury accident, the effects ripple through every part of life, not just in medical bills or a few missed days of work. Florida law allows you to seek compensation for a full range of damages, and understanding what qualifies can change the outcome of your claim.

You can pursue economic damages like hospital expenses, rehabilitation costs, and lost income, as well as projected future care if the injury causes lasting complications. Just as important are non-economic damages—pain and suffering, emotional distress, and the ways your injury has interrupted daily routines or limited your independence.

These losses may not come with a price tag. However, the law doesn’t ignore them. Under Florida Statutes § 627.737, both categories are recognized and compensable. These distinctions matter.

Call for Backup: How Robert J. Johnson Can Help You Deal with the Insurance Company

When the insurance company starts calling, no one hands you a manual. You're hurt, you're uncertain, and now you're supposed to say all the right things to a trained professional who already knows the rules and knows you probably don’t.

Our job isn’t just to react. We push back. We question the numbers, the fine print, and the convenient omissions. We make sure nothing gets left out, not the missed work, not the pain, not the nights you couldn’t sleep. Everything you’ve lost deserves its place in the story.

And through it all, the law stays on your side. Florida law. Your rights, protected. Your recovery, prioritized.

No upfront fees. We only get paid when you do.

This approach makes a difference. 85% of all personal injury payouts from insurance companies go to claimants with legal representation

If you've been injured, contact us today. Let's talk about how we can help.